If you were injured in a motor vehicle while driving, as a passenger in a vehicle on the roads or as a pedestrian, you may be eligible for Physiotherapy which is covered by third party insurance (CTP insurance).

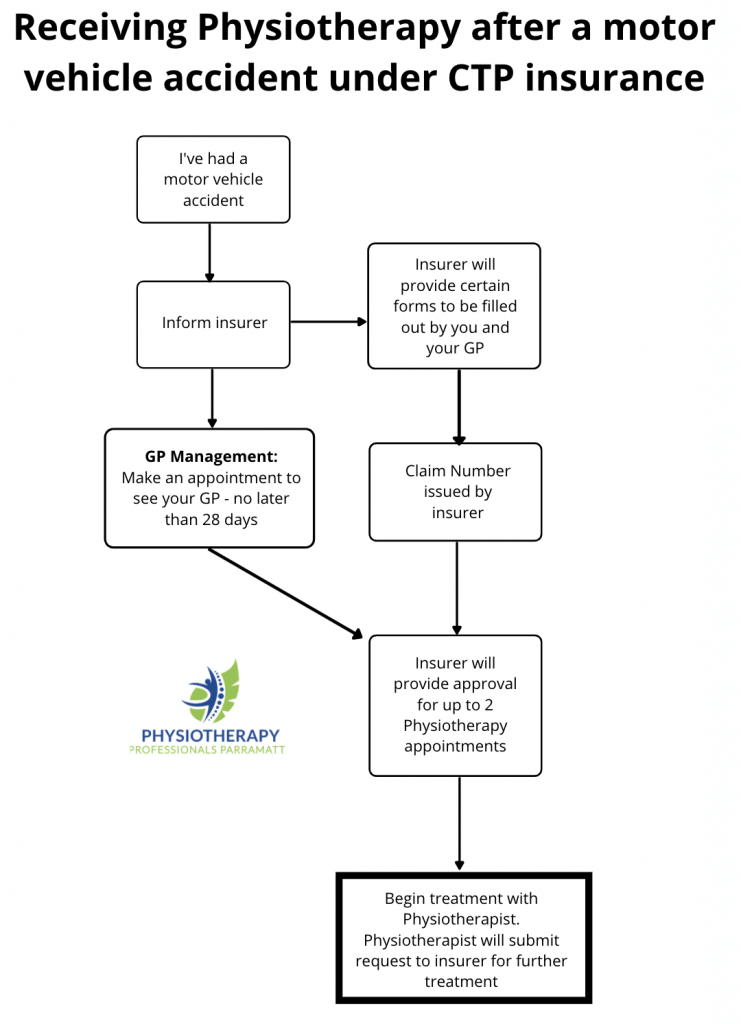

Steps to take before Physiotherapy can start:

- Exchange details at site of accident

- Contact details

- Insurance details

- Contact 3rd party insurance provider – they will issue you with a claim number

- See your GP as soon as possible (Within 30 days after your accident)

- Contact your Physiotherapist with claim number issued by insurance company

Motor vehicle accidents (MVA) can happen any time and can cause a lot of headache and grief. CTP insurance may cover for your Physiotherapy treatment. Physiotherapy After a Motor Vehicle Accident is crucial and can prevent long term spinal complications.

Please note, prior approval from your CTP insurance company is required. You will also need to visit a GP after your accident, before you can be seen by a Physiotherapist. Not all symptoms will appear immediately after the accident, some symptoms and pains can develop a few days after the accident has taken place. The body often goes into “protection mode” for safety to prevent further damage after an accident. Once the body starts to relax, the pain will will become more apparent.

Steps to take after a car accident:

Do I Have To Pay for Treatment?

No, we will bill the insurer if all of the following exists:

- Valid claim number from your insurance company

- Approval letter or email for Physiotherapy from the insurance company

Contact Physiotherapy Professionals Parramatta. We will assist you with pain management and get you back on track as soon as possible.

CTP Third Party Claims Parramatta: Whiplash Management Guide

If you’ve had a motor vehicle accident and are currently suffering from symptoms, get in touch with Physiotherapy Professionals Parramatta. If you are unsure of the process or where to go, we can guide you through the process and direct you on the right path.

Contact Us:

Please email us on [email protected] or call us on 0479 080 800 for further information.